Crypto Coin Insurance: first optional cryptographic change with the possibility of deposit insurance

Cryptocoin Project Insurance

are financial derivatives sold by option authors for option buyers. The contract offers the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at an agreed price over a specified period of time or on a specific date. The agreed price is called the strike price. There are many types of options. One option can be done at any time before the option expiration date, while other options can only be done on the expiration date (training date). Exercising means using the right to buy or sell the underlying security.

Sounds very difficult! That is why this project is divided into two parts: option exchanges and insurance companies:

Traders and hedge funds conclude stock option purchase and sale transactions

Other clients, who don’t want to know how to work options can buy insurance for the growth or fall of the main crypto currency.

Cryptocoin insurance has two main sources of income

IDEA

In the event of an insured event, CRYPTOCOIN INSURANCE pays the client insurance against previously received insurance. If there was no insured event, the insurance paid by the client will be the company’s income.In fact, this is the option mentioned above. However, in order not to embarrass a huge number of customers who do not understand and do not want to deal with options, CRYPTOCOIN INSURANCE has created a two-in-one solution:

In most cases, the company that first enters the market, as we know, becomes the leader and always occupies the largest share. Today CRYPTOCOIN INSURANCE has no competitors and occupies the entire market.

PROBLEM DESCRIPTION

1. There is no solution to insure a deposit in Bitcoin or Ethereum from falling.

At the same time, there is increased volatility in this market, which makes people afraid to keep large amounts of money in cryptocurrency. On the other hand, large companies are slow to enter the market (for example, do not accept payments in cryptocurrency) for the same reason.

At the same time, there is increased volatility in this market, which makes people afraid to keep large amounts of money in cryptocurrency. On the other hand, large companies are slow to enter the market (for example, do not accept payments in cryptocurrency) for the same reason.

2. There is no special cryptocurrency exchange where you can buy / sell options.

The main fear of creating such an exchange is increased volatility. Anyone who deals with stock options, oil or wheat, it seems that the risks are huge.

The main fear of creating such an exchange is increased volatility. Anyone who deals with stock options, oil or wheat, it seems that the risks are huge.

3. There is still no possibility of short sales on the cryptocurrency market.

No one can sell a cryptocurrency that is physically absent on the account for a short period of time. This reduces the ability of speculators to smooth price fluctuations in other markets. In turn, this leads to an increase in volatility and the consequences listed in paragraphs 1 and 2 above.

No one can sell a cryptocurrency that is physically absent on the account for a short period of time. This reduces the ability of speculators to smooth price fluctuations in other markets. In turn, this leads to an increase in volatility and the consequences listed in paragraphs 1 and 2 above.

SOLUTIONS

1. CRYPTOCOIN INSURANCE allows you to insure the risks of rising or falling prices for basic cryptocurrencies.

The exchange will start working with 5 cryptocurrencies that have a maximum market. In addition, as demand and turnover increase, other cryptocurrencies will be added.

CRYPTOCOIN INSURANCE sells insurance, both on Bitcoin and on Ether. Thus, hedging the risk. The lack of competition in the market allows you to maintain a significant margin of 20%. CRYPTOCOIN INSURANCE repacks and sells / buys its own risk as options on its own exchange.

2. CRYPTOCOIN INSURANCE creates the first cryptocurrency, option exchange.

The main fear of options in the cryptocurrency market is increased volatility. But is it really?

The main fear of options in the cryptocurrency market is increased volatility. But is it really?

Consider the example of the usual stock market. For example, a client has sold an option on a share of the company ZZZ. Today is Saturday and the market is closed. There are unexpected good news and stocks are rising at the opening of the market on Monday 2-10 times. In its turn, the option seller suffers huge losses.

The advantage of the cryptocurrency market in contrast to the stock or commodity is that it operates 24 hours a day. And for the entire period of its existence (about 10 years) there was not a single news that would quickly shift the price of Bitcoin or Ethereum by at least 30-50%. In fact, if we are talking only about blue chips, the cryptocurrency market is much safer for option sellers than other markets we are used to.

3. Options allow short sales.

Without physical Bitcoin or Ethereum, you can get an option to drop them, and actually make an uncovered sale.

Without physical Bitcoin or Ethereum, you can get an option to drop them, and actually make an uncovered sale.

This opportunity brings to the market a lot of new traders, investors and speculators, as well as hedge funds, who invest not only in growth but also in falling markets.

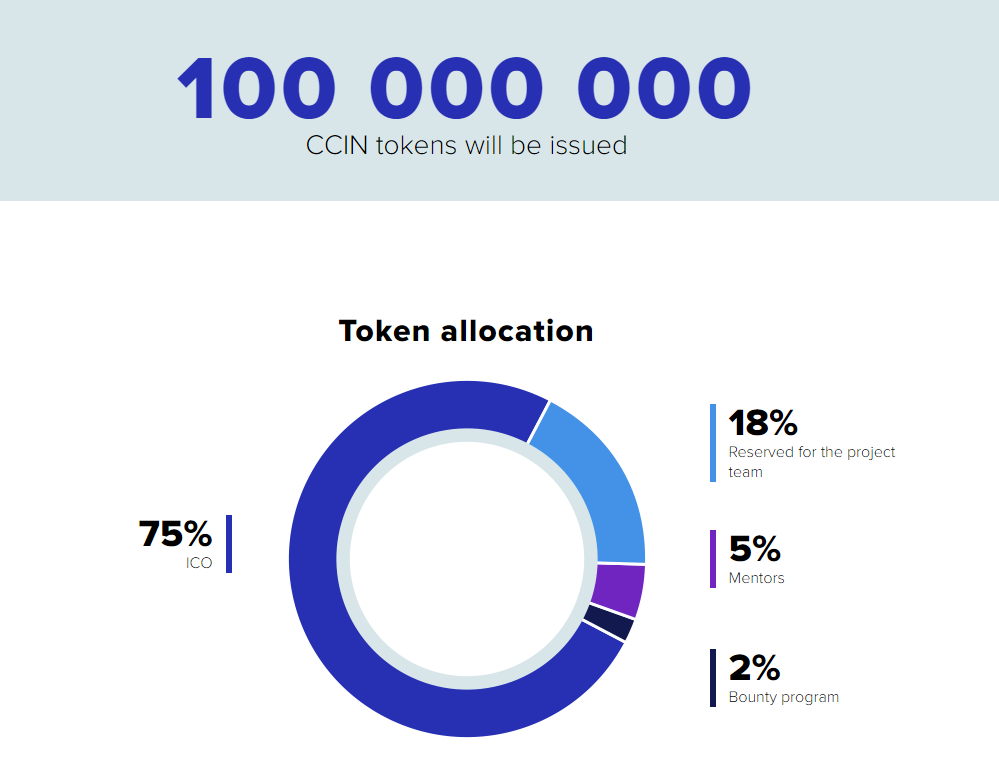

token allocation

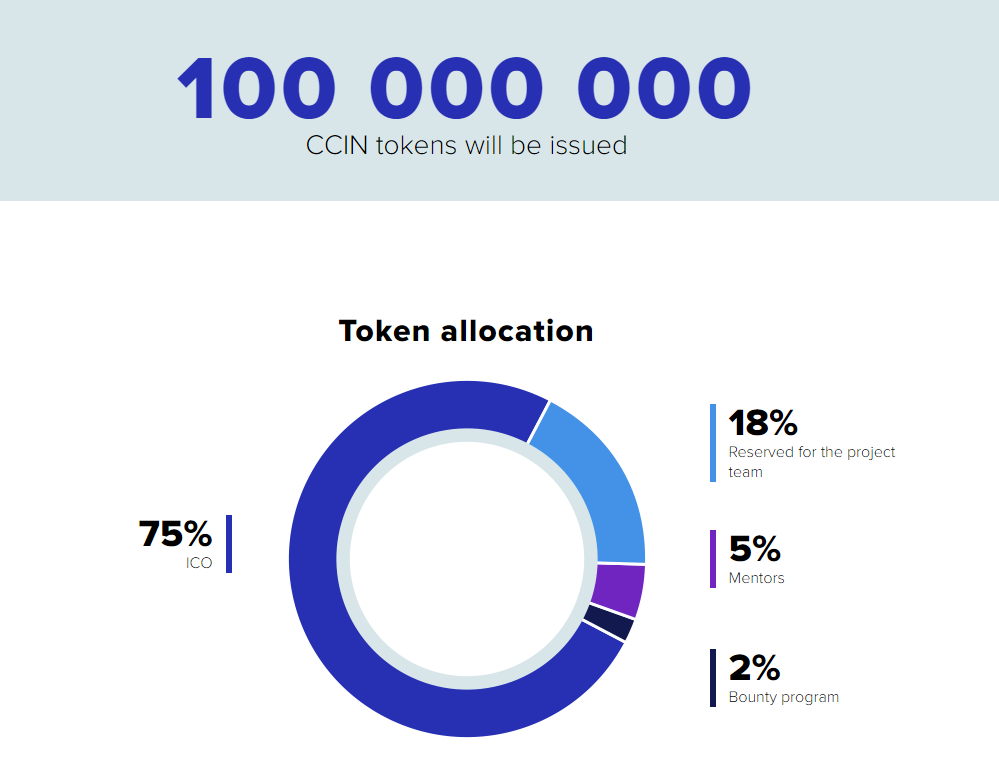

growth potential

growth potential

CRYPTOCOIN INSURANCE has developed a simple and understandable model to increase the cost of the CCIN token. 30% of every commission received from the stock exchange flows into the liquidity fund. Within the next month, CRYPTOCOIN INSURANCE sends these funds to buy CCIN tokens from the market and burns them.

This business model is used exclusively in the interests of investors. The promise to buy tokens from future profits can not be transparent. In addition, a stock exchange or platform can never physically benefit. In the case of CRYPTOCOIN INSURANCE, investors know exactly what each buy / sell transaction generates for a transaction that generates the cash flow used to buy tokens.

This business model is used exclusively in the interests of investors. The promise to buy tokens from future profits can not be transparent. In addition, a stock exchange or platform can never physically benefit. In the case of CRYPTOCOIN INSURANCE, investors know exactly what each buy / sell transaction generates for a transaction that generates the cash flow used to buy tokens.

This allows you to constantly shift the market balance and increase the demand for CCIN tokens.

If the revenue is $ 50 million per day, the commission for both sides is $ 500,000 or $ 15 million per month. 30% of this amount, or $ 5 million a month, will be sent to buy CCIN tokens from the market.

for more information visit the following link:

Website:http://ccin.io/

WHITE PAPER: http://ccin.io/doc/Whitepapereng.pdf

ANN: https://bitcointalk.org/index.php?topic=4948618

TWITTER: https://twitter.com/ccin_official

FACEBOOK: https://www.facebook.com/ccinofficial/

TELEGRAM: https://t.me/ccin_official

MEDIUM: https://medium.com/@ccin_official

for more information visit the following link:

Website:http://ccin.io/

WHITE PAPER: http://ccin.io/doc/Whitepapereng.pdf

ANN: https://bitcointalk.org/index.php?topic=4948618

TWITTER: https://twitter.com/ccin_official

FACEBOOK: https://www.facebook.com/ccinofficial/

TELEGRAM: https://t.me/ccin_official

MEDIUM: https://medium.com/@ccin_official

author:

rivaldo2020

BTT Profil link:

https://bitcointalk.org/index.php?action=profile;u=2051385

0x320f6344D4BE878C96e77AD580e2EE132C4BF6F8

No comments:

Post a Comment