INSCOIN: Token for The KNOX

ABOUT INSCOIN

The

insurance industry relies heavily on the notion of trust among

transacting parties. For example, when you go to buy car insurance you

get asked for things like your zip code, name, age, daily mileage, and

make & model of your car. Other than, maybe, the make & model of

your car you can pretty much falsify other information about yourself

for a better insurance quote. Underwriters trust that you are providing

the correct information, which is one of the many risks in the

underwriting business.

Blockchain

has proven its potential of providing the transparency and integrity in

most of the business processes. Over the last few years, Blockchain has

been considered as an important strategy in most of the consumer facing

businesses, mainly in banking, insurance, and logistics. And quite

naturally, the blockchain hype has also knocked on the doors of

Insurance companies.

Blockchain can be a good solution for a number of insurance use cases such as:

- Reducing frauds in underwriting and claims by validating data from customers and suppliers in the value chain

- Reducing claims by offering tokenized incentives to promote safer driving behavior by capturing data from insured entities like motor vehicles

- Enabling pay-per-mile billing for insurance by keeping verifiable records of miles traveled

- Eliminate intermediaries

- Determine liability in case of an accident between two autonomous vehicles by managing timestamped immutable records of decisions made by deep-learning models from both autonomous vehicles right before the accident.

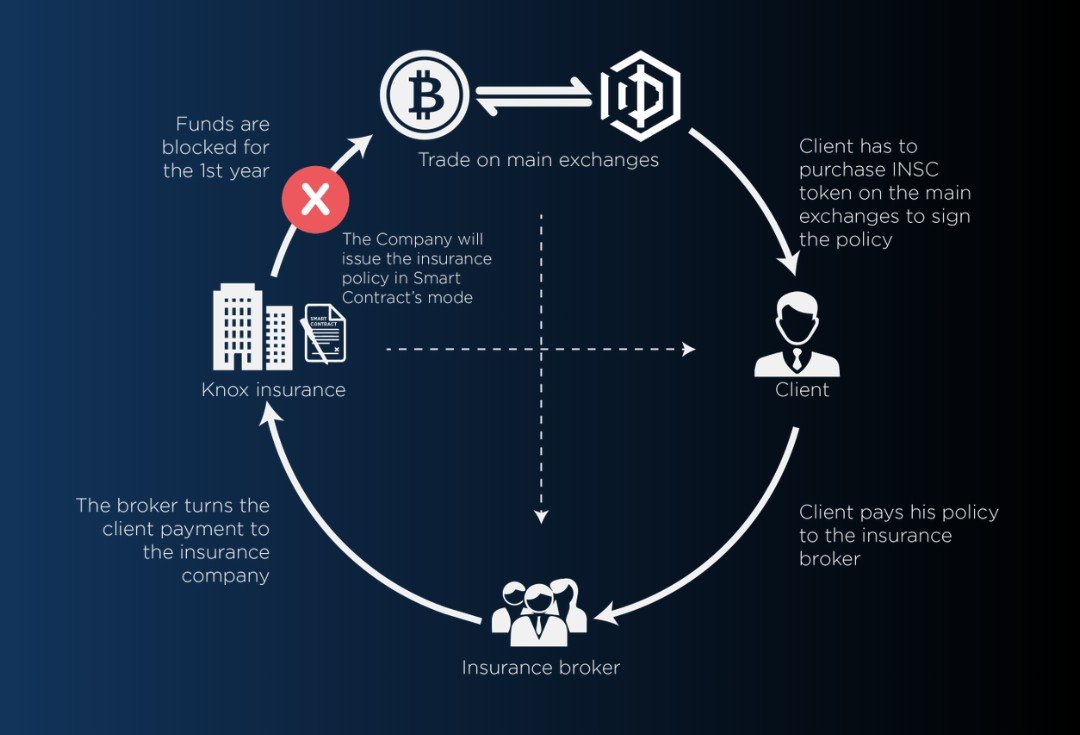

The KNOX

project is world's first Blockchain-based insurance company. Leveraging

blockchain technology, the project aims to create the most

efficient and advanced structure in the sector, to find a solution to

the problem of certification and anti-forgery of insurance policies.

The KNOX

goal is to reach a decentralization of the whole insurance system, to

transform the traditional insurance policies from paper into smart

contracts. By using smart contract, the KNOX provides numerous benefits,

as a result of smart contract features, include in:

- With the smart contract the spread of false insurance policies is avoided because it is the same system that issues them after receiving the payment.

- With the smart contract the company won't have delay in collecting credits, as the policy is issued only after receiving the payment.

- With the smart contract in the event of accidents the real judge who will decide whether or not to pay them is no longer the company, which could have an opportunistic behavior, but the blockchain system that, in a totally disinterested by the human opinion, will decide if this accident is compliant with the provisions in the policy.

In order to

realize the goal, the KNOX developed the INSCOIN token. INSCOIN will

act as the platform’s transactional medium. Consumers can pay insurance

premiums and can access the maximum degree of authenticity of the

policy, receiving it in the form of smart contract, through INSCOIN.

For more information about the KNOX or INSCOIN, you can visit the following links :

Website : https://www.inscoin.co/

Whitepaper : https://inscoin.co/assets/content/whitepaper_en.pdf

Telegram: https://t.me/inscoinico

Twitter: https://twitter.com/inscoinforknox

author:

BTT username: rivaldo2020

BTT profile link: https://bitcointalk.org/index.php?action=profile;u=2051385

No comments:

Post a Comment